Refinancing a home loan can be a powerful financial tool when used wisely. But it’s not a one-size-fits-all solution. Knowing when refinancing makes sense can save you money and improve your financial health. Let’s explore what refinancing is, why people consider it, and how to decide if it’s the right move for you.

What Is Refinancing?

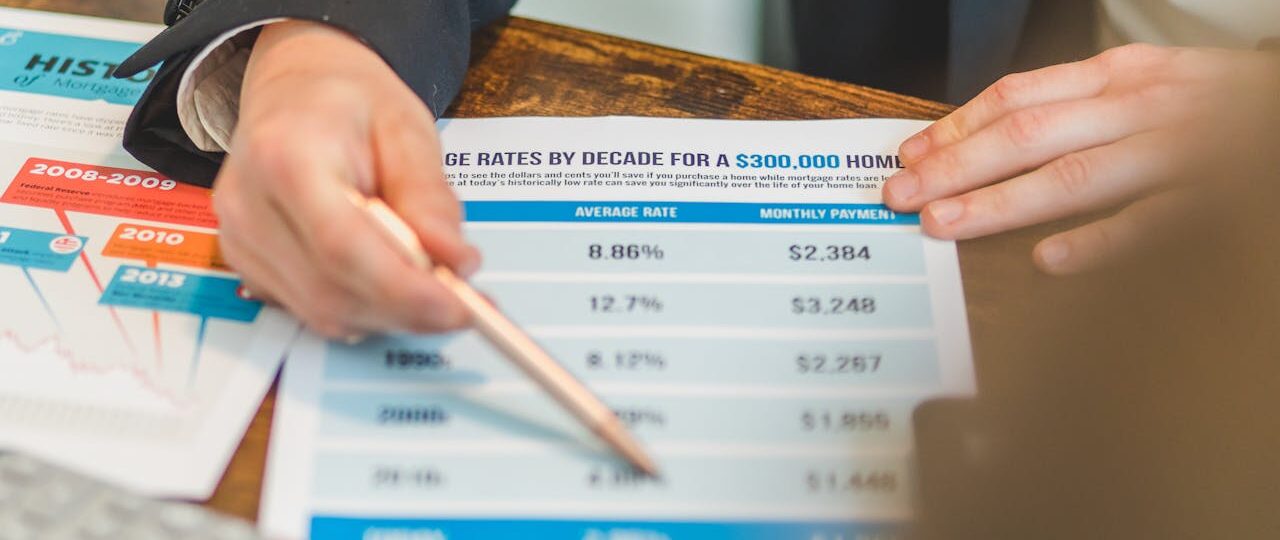

Refinancing means replacing your current mortgage with a new loan, often with different terms. Homeowners typically refinance to get a lower interest rate, reduce monthly payments, or access cash by tapping into their home’s equity. Sometimes people refinance to switch from an adjustable-rate mortgage to a fixed-rate one, aiming for stability.

Why Refinance?

The main goal of refinancing is to improve your loan terms and save money over time. Interest rates fluctuate, so if …

When it comes to selecting a lender for your next loan, one of the most critical factors to consider is the interest rate they offer. The interest rate will determine how much you ultimately pay back on top of the principal amount borrowed. A lower interest rate can save you money in the …

When it comes to selecting a lender for your next loan, one of the most critical factors to consider is the interest rate they offer. The interest rate will determine how much you ultimately pay back on top of the principal amount borrowed. A lower interest rate can save you money in the …

As mentioned above, one of the most significant advantages of working with a mortgage broker is having access to multiple lenders. They can shop around and find the best possible interest …

As mentioned above, one of the most significant advantages of working with a mortgage broker is having access to multiple lenders. They can shop around and find the best possible interest …

Having a healthy cash flow is a must for any business. This means having enough money coming in to cover your expenses and leaving some left over for growth. But it’s not always easy to achieve this, especially when starting out. A chartered accountant can help you optimize your cash …

Having a healthy cash flow is a must for any business. This means having enough money coming in to cover your expenses and leaving some left over for growth. But it’s not always easy to achieve this, especially when starting out. A chartered accountant can help you optimize your cash …