Refinancing a home loan can be a powerful financial tool when used wisely. But it’s not a one-size-fits-all solution. Knowing when refinancing makes sense can save you money and improve your financial health. Let’s explore what refinancing is, why people consider it, and how to decide if it’s the right move for you.

What Is Refinancing?

Refinancing means replacing your current mortgage with a new loan, often with different terms. Homeowners typically refinance to get a lower interest rate, reduce monthly payments, or access cash by tapping into their home’s equity. Sometimes people refinance to switch from an adjustable-rate mortgage to a fixed-rate one, aiming for stability.

Why Refinance?

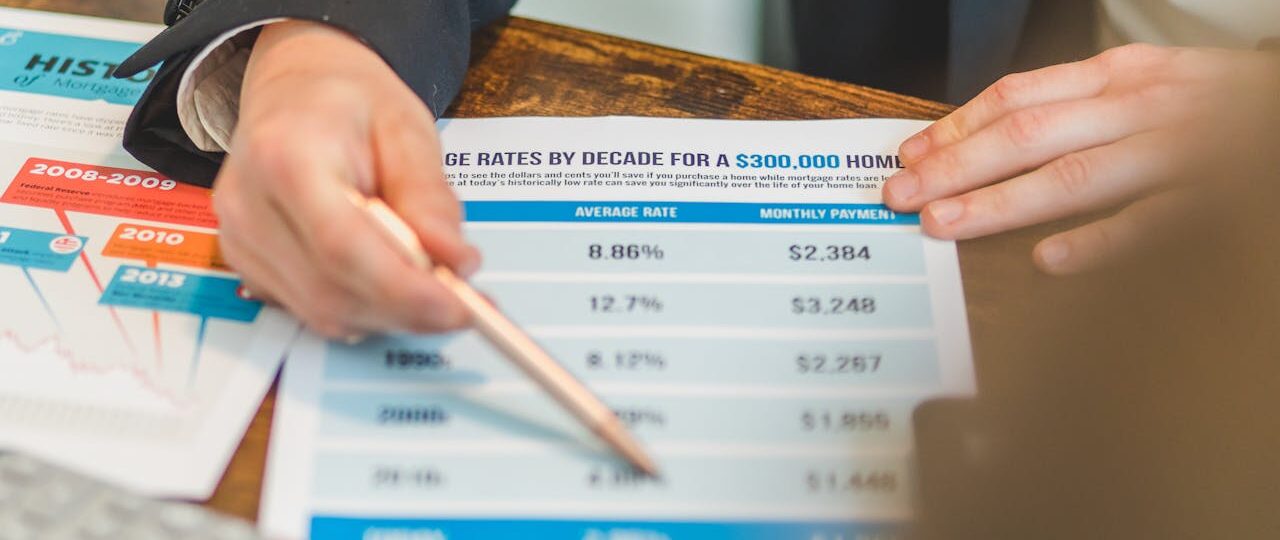

The main goal of refinancing is to improve your loan terms and save money over time. Interest rates fluctuate, so if rates have dropped since you took out your original mortgage, refinancing might lower your payments. It can also help you shorten your loan term, allowing you to pay off your home faster. Another reason to refinance is to consolidate debt or finance major expenses by cashing out part of your home’s equity. This strategy can be risky if not done carefully, but it’s a common option.

When Does Refinancing Make Sense?

Timing is everything. Refinancing isn’t free; it comes with closing costs, appraisal fees, and sometimes penalties for paying off your old loan early. To make it worthwhile, the savings from the new loan should outweigh these costs. A good rule of thumb is if you can lower your interest rate by at least half a percentage point, refinancing might be beneficial. This can translate to substantial monthly savings. If your credit score has improved since your original loan, you may qualify for better rates now. That unique advantage can also make refinancing attractive. Another scenario is if you want to switch from an adjustable-rate mortgage to a fixed-rate loan to ensure stable payments, especially if interest rates are rising. Stability can be worth the cost.

The Role of Credit and Financial Health

Your credit score plays a crucial role in refinancing. A higher credit score can qualify you for lower interest rates, making refinancing more advantageous. If your score has improved since your original mortgage, it’s a unique opportunity. Ensure your financial situation is stable before refinancing. Lenders will look at your income, debts, and employment status. If you’ve recently had financial setbacks, refinancing could be more difficult or less favorable.

Cash-Out Refinancing: Use With Caution

Cash-out refinancing lets you borrow more than you owe and take the difference in cash. Many homeowners use this to renovate their homes or pay off high-interest debt. While this can be helpful, it’s important to approach it cautiously. You’re increasing your loan balance and putting your home at greater risk if you can’t keep up with payments. Ensure you have a clear plan on how to use the cash wisely and a repayment strategy.

In Conclusion

Refinancing your home loan can be a smart move, but it requires careful thought. Look at your current interest rate, loan terms, credit score, and financial goals. Calculate your break-even point and shop around for the best deals. Remember, refinancing isn’t about chasing the lowest rate alone. It’s about improving your overall financial situation and making choices that fit your unique needs. When done right, refinancing can save you money, reduce your debt faster, and even help you tap into your home’s value. Keep these points in mind to ensure you make the utmost of this financial opportunity.